There's been a lot of talk of multifamily pricing over the last year or so, with a slew of high-profile lawsuits alleging that software is forcing prices upwards across the USA. In a December 2023 newsletter, NMHC did a thorough job of showing how record supply is placing downward pressure on rents.

NMHC's extensive analysis makes it clear that it is supply and demand, not software, that drives pricing across multifamily markets. But that is not the subject of this article (for more details on that, download our recent white paper that explains this subject in depth.) This article uses some operational data (from my friends at Radix) to show how this macro trend (supply) affects the revenue management decisions that individual properties make.

To understand the specific tactics we can see in the market, we must understand the range of conditions that apply across the US multifamily market. We can broadly categorize markets into three different archetypes:

- Low supply and strong demand: Northeastern markets, for example, like New York, have seen relatively little new inventory, and demand remains strong as the market continues its recovery from the pandemic.

- Low supply and soft demand: Some markets, e.g., West Coast, saw a flight from cities during the pandemic, but unlike the Northeast, the recovery of cities has been much slower.

- Oversupply: Many markets, especially where there are low barriers to entry (e.g., the sunbelt) are seeing record new supply, and demand looks like it will take some time to catch up.

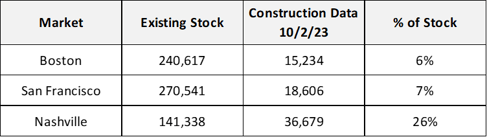

Unsurprisingly, the apartment pricing tactics and likely outcomes look quite different in each case. A good metric for changing supply conditions is the percentage of stock currently under construction in each market. It not only indicates current conditions, but also gives a sense of where things are likely to go in 2024. For this analysis, my friends at Radix provided data for three different cities.

Source: Radix and BuildCentral

Source: Radix and BuildCentral

The two low-construction examples are Boston and San Francisco, where new construction represents growth of 6% and 7% of the total multifamily inventory, respectively. Nashville, on the other hand, has a whopping 26% of its entire multi-family inventory currently under construction.

Let's look at two important metrics that tell us what that means for pricing in each market. First, let's look at net effective rent—i.e., the actual rent, including discounts and incentives that are usually applied to asking rents.

Source: Radix

Boston is mostly maintaining its net effective rate with only a relatively small decrease over the second half of 2023. Both San Francisco and Nashville saw significant declines over the same period. This trend is thrown into sharp relief when we overlay the average monthly concessions (the financial incentives that communities offer prospective renters to sign a lease).

Below, we see that concessions started to pick up in Nashville through the second half of 2023. It is important to note that the average monthly concessions are for stabilized properties only and do not include lease-ups. Given the huge volume of new inventory in this market, we should view the numbers in the chart as conservative and that concessions will climb for the foreseeable future. San Francisco has also crept up through the same period of the year, whereas Boston has remained relatively flat.

Source: Radix

It is important to note that in all of these markets, companies are using revenue management applications at something approximating the same rate. And yet, the pricing trends are quite different in each market.

Boston has little new supply to meet growing demand, so its net effective rents are trending up, and concessions are mostly negligible. Nashville represents the opposite, with a sharp downward trend in effective rents and concessions trending upwards toward pandemic levels. San Francisco's blend of little new supply and stagnant demand means relatively high concessions since the pandemic and declining rents.

As a revenue management advocate, I expect companies doing revenue management well to lose less money this year in markets where demand does not meet supply and make more money where apartments are scarcer. But in all cases, revenue management is trying to make the best of a situation that is fundamentally caused by the marriage of supply to demand.

Revenue management is powerless to cause price increases because the software has no power to control markets—that is the job of supply, as the examples above demonstrate. Prepare for some choppy times in most markets in 2024.

Photo by Helena Lopes on Pexels