As companies seek to centralize property management functions, they find themselves coming up against rigidly property-based processes. Leasing—the highest profile of these functions—owes its design to the "coverage" model. Properties always needed at least one person on duty to answer phones, conduct tours, and support the leasing process. Companies centralizing leasing operations have to reimagine processes, tasks, and ultimately, jobs that have been the same way since time immemorial.

The benefits, of course, are obvious. Centralized leasing capabilities allow agents to sell sister properties, wasting fewer leads when one property cannot match a prospect to a unit. Clusters of properties can, in some cases, pool agents and focus their time wherever the greatest need exists, improving their ability to deal with peaks and troughs in demand.

These substantial benefits have become familiar to multifamily operators, who are increasingly motivated to overcome the property-centric bias in staffing. What may be less familiar is the influence of the same bias on the broader marketing process.

How the Property-Centric Bias Affects Marketing

When we think about how people search for apartments, we see a disconnect between multifamily operators and prospects. It ultimately boils down to the same issue: multifamily sees the world from the property outwards.

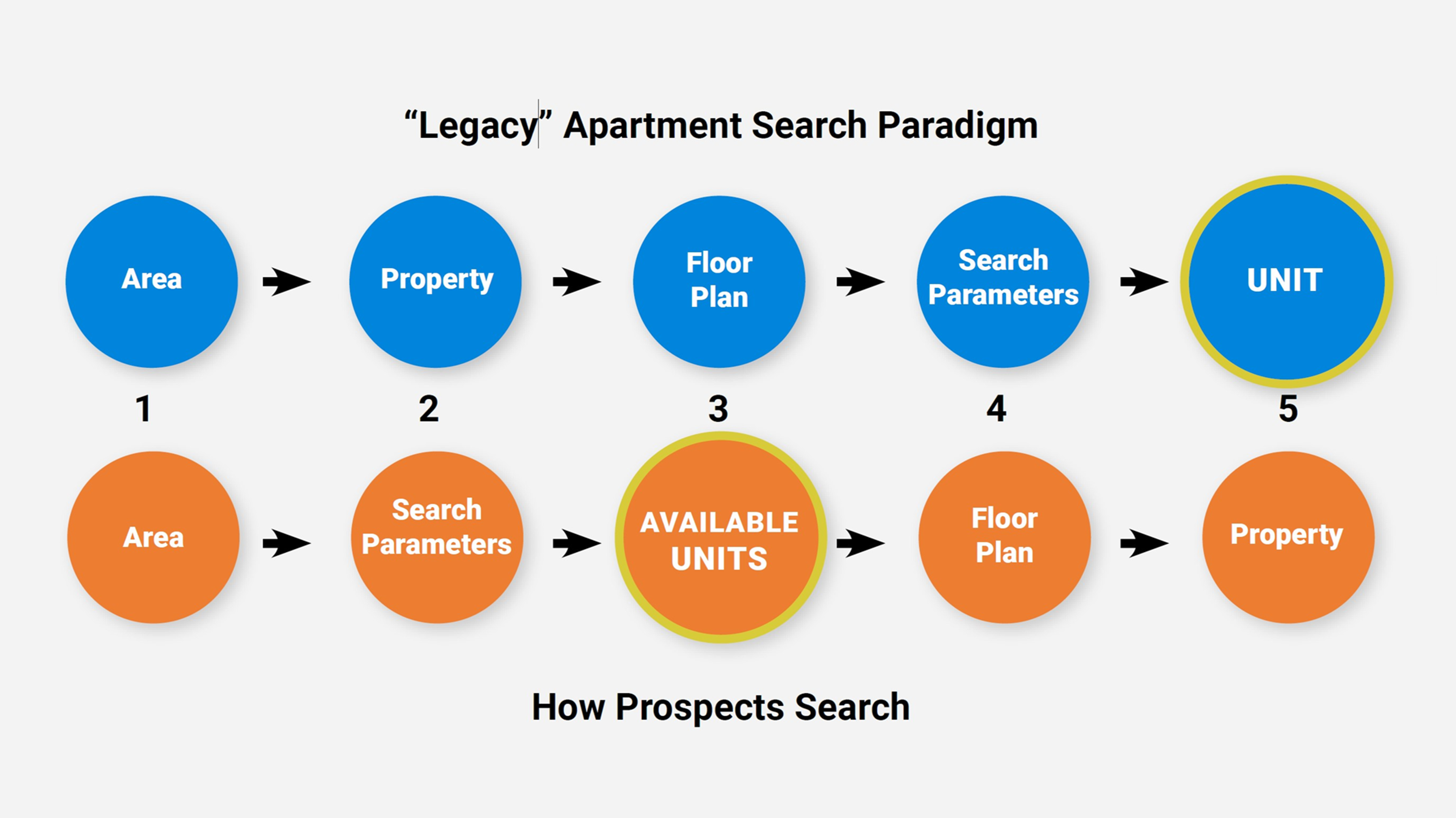

The diagram above, taken from a recently published 20for20 paper, "Rethinking Multifamily Websites," illustrates the contrast between how consumers look for apartments and how most companies enable them to search (the "legacy apartment search paradigm"). Our industry has framed apartment search as if prospects start by searching for properties within an area. Floor plans and search parameters (like dates and price ranges) are downstream of the property, and the specific unit only arrives late in the search, if at all.

The flaw with this model is that it places the property at the top of the consideration hierarchy. If we instead consider how prospects would naturally search (focusing on the orange dots above), we see a different picture. For apartment search to be consistent with great e-commerce experiences, we should expect prospects to select an area and then refine their search with parameters like move-in dates and budgets, which tend to be hard constraints. From there, the next logical step is to search for available units.

That represents a significant change as it flips unit and property in the hierarchy. But thinking about excellent e-commerce experiences (think Amazon, for example), it seems fair to assume prospects want to find available homes that fit their requirements before spending time researching properties that may or may not have availability. The home is more central to that selection than the property of which it is a part. To put it another way, the property is an attribute of the unit, not the other way around.

This concept should make intuitive sense if you've ever attempted to buy or rent a single-family property. It is easy to find detailed information about individual single-family homes, so it is unlikely that the apartment industry will fail to follow suit.

Overcoming The Bias

We might ask why this disconnect continues to exist. The answer lies in our ingrained property-centric bias. As a real estate industry, we raise capital, develop, lease and oversee the operations of properties. We closely scrutinize the performance and evaluate investments at the community level. These characteristics are fundamental to how multifamily companies see the world.

But our prospects are looking for their next home and may be more or less interested in the community of which it is part. The property-centric design paradigm is a roadblock to those who see value in offering an excellent e-commerce experience, just as it is to companies trying to change their staffing models.

This paradigm is bound to shift: we already see a range of products and tools offering immersive online experiences designed to put the prospect into the unit they are considering renting. We have also seen how single-family homes for sale websites have incorporated comprehensive information about individual homes. All the necessary technology already exists and is being adopted to enable a similar shift in multifamily.

Enabling unit-level search seems like an obvious next step for multifamily marketing. ILSs are already leading the charge toward adding these capabilities to their websites. The pertinent question for operators might be: Should we offer unit-level search to prospects only through ILS partners, or should our websites offer the same experience? The answer to that question should be obvious.