NMHC OPTECH is just a week away, and I've been taking a look at this year's audience composition. At the time of writing, the total number of attendees has surpassed any previous year, making this year's show the biggest ever—congratulations to the organizers! Whatever economic uncertainty our industry is facing, the enduring popularity of NMHC OPTECH tells us that our industry's appetite for technological innovation is stronger than ever.

As someone deeply invested in monitoring trends in operations and technology, I consider it part of my job to keep a pulse on who is doing what. OPTECH usually provides plenty of clues that help us to understand the developing vendor landscape. I've been looking at the attendee data for this year's show—let's look at what it tells us.

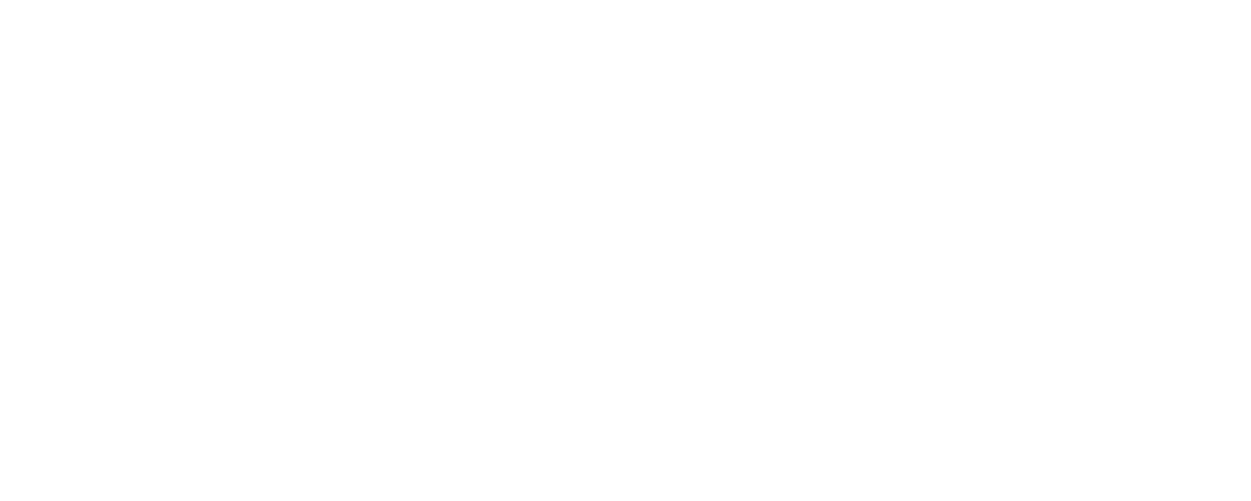

Firstly, the overall numbers tell us that most attendees are vendors. That is normal: since I've been attending OPTECH there has always been at least a 60-40 split between vendors and property management companies (PMCs). This year, as the chart below indicates, about 90% of attendees are either multifamily owner-operators or vendors. Of this, 60% are vendors, and 30% are PMCs, essentially a 2-to-1 vendor-to-buyer ratio.

That ratio is a bit higher than usual, but given OPTECH's position as the vendor showcase in multifamily, I view this as positive. Of course, a higher density of vendors probably means a higher volume of invitations to each owner-operator, but it's good to be popular!

What you may be missing about the vendor landscape

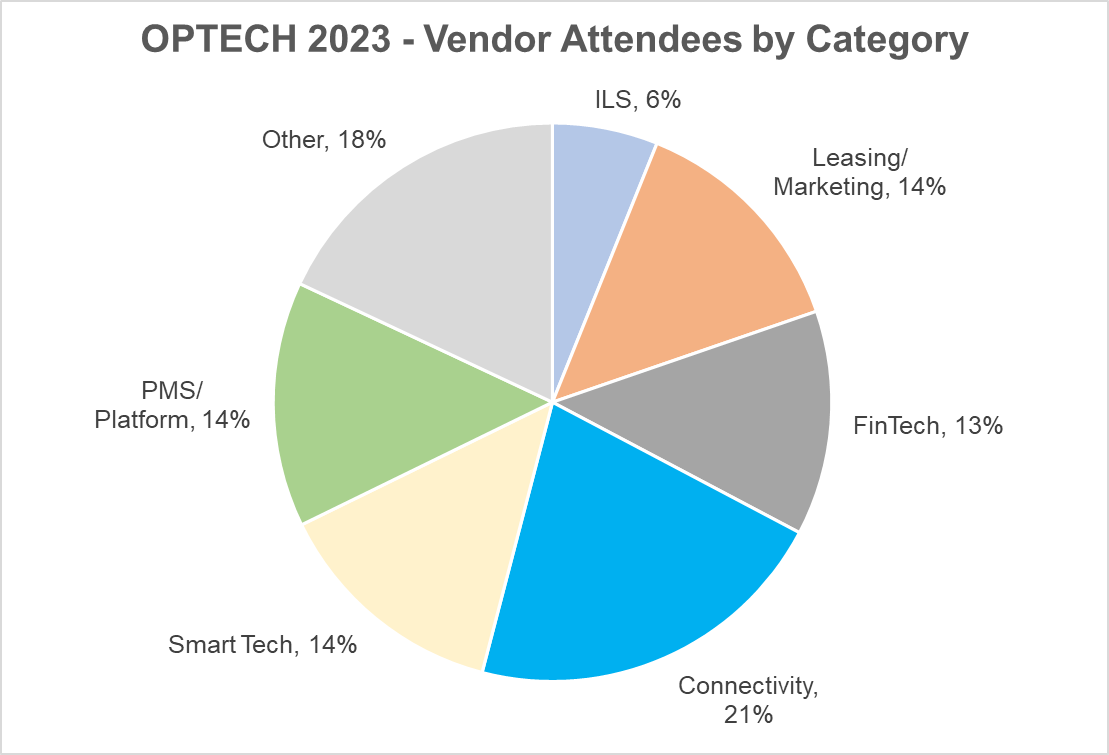

What is more interesting is the composition of the vendors that make up that 60% of attendees. It's never 100% satisfactory to put vendors into categories: the influx of venture capital into the multifamily tech sector over the last few years has resulted in some functional overlap between solutions (think how many different tech cos provide resident apps). But there are some mostly reliable product classes, into which I have grouped the vendor attendees in the chart below.

In the lead-up to OPTECH, industry hype would probably lead us to believe that leasing and marketing technologies would be the dominant force at the show. Common sense would tell us that the large platform providers—from whom most companies buy most of their technology—would constitute the majority of attendees. Neither preconception is reflected in the numbers.

The most striking observation is that, by far, the biggest sector by attendee numbers is connectivity providers. Purveyors of networks and fiber make up over 20% of the attendee base, about 50% more than either PMS platform providers or leasing and marketing tools. If we combine connectivity with smart tech companies (many of whom also provide connectivity), the combined total is more than a third of all attendees. I doubt most attendees would have guessed as much, and that is a story.

The big takeaway

A couple of years ago, the 20 for 20 annual paper noted a dichotomy in how companies approach technology. On one hand, there are "enterprise technologies" like property management systems, CRM, and accounting software. On the other, there are technologies requiring physical installation at properties, such as smart tech and connectivity. There was and still is a disparity in the level of attention paid by leaders to these two areas. Senior management, we observed, both in operations and technology, are typically well-informed about developments in enterprise tech but may lack a similar understanding of true proptech. This knowledge gap presents both a risk for multifamily operators and an opportunity for vendors.

The technology we install in properties has gained importance recently. Residents increasingly expect robust Wi-Fi in buildings and an ever-increasing set of amenities (smart devices, EV charging, TV streaming, etc.) that require strong, reliable internet. At the same time, operators benefit from more tech-enabled operations, access control, self-guided tours, package solutions, and so on.

Improved financial performance and customer experience are intertwined. And companies are finding the economics of offering such connectivity in exchange for a technology fee increasingly compelling. However, the implementation of physical equipment has its own risks and complexities, all of which must be understood, usually in the context of individual properties.

Property-based technology decisions don't fit into the conventional "top-down" paradigm that used to characterize technology purchasing. That is particularly the case in a third-party management environment, where owners and operators represent diverse needs and technology priorities. (Stay tuned for a more detailed article about that in the next couple of weeks.)

Planning your OPTECH dance card

But property technology is looking more and more like a blind spot for operations and technology leaders. And as legacy cable contracts expire, most multifamily communities will need to make informed decisions about a crucial element of their future technology infrastructure.

Next week at OPTECH, I will present preliminary findings from research I've conducted with leading operators and connectivity providers. The goal of that research is to improve awareness and understanding of what is becoming an increasingly vital technology area within our sector.

You can attend this "OPTECH Openers" session on the afternoon of Wednesday, November 1st. Alternatively, you can arrange a meeting with one of the many excellent connectivity technology providers I've had the pleasure of engaging with recently (plenty of them will be at the show!) Either way, keep in mind how many of the tech discussions at this year's OPTECH will center around physical installations in properties.

See you in Las Vegas!

Photo by San Fermin Pamplona on Pexels